- English

- Español

- Português

- русский

- Français

- 日本語

- Deutsch

- tiếng Việt

- Italiano

- Nederlands

- ภาษาไทย

- Polski

- 한국어

- Svenska

- magyar

- Malay

- বাংলা ভাষার

- Dansk

- Suomi

- हिन्दी

- Pilipino

- Türkçe

- Gaeilge

- العربية

- Indonesia

- Norsk

- تمل

- český

- ελληνικά

- український

- Javanese

- فارسی

- தமிழ்

- తెలుగు

- नेपाली

- Burmese

- български

- ລາວ

- Latine

- Қазақша

- Euskal

- Azərbaycan

- Slovenský jazyk

- Македонски

- Lietuvos

- Eesti Keel

- Română

- Slovenski

- मराठी

- Srpski језик

38.1%! The European Union has decided to walk away from the table

2024-06-13

The European Union's tariff stick is about to fall.

On June 12, the European Union Commission issued a preliminary ruling on the anti-subsidy investigation of electric vehicles in China, proposing to impose temporary countervailing duties on electric vehicles imported from China.

The European Union Commission announced that if it cannot solve this with China, it will start to impose tariffs on July 4.

Among them, tariffs of 17.4%, 20%, and 38.1% will be imposed on BYD, Geely Auto, and SAIC Motor Group respectively; tariffs of 21% or 38.1% will be imposed on other automakers; Tesla imported from China may be subject to separate tax rates.

The European Union Commission said it would impose a 21% tax rate on automakers deemed to be cooperating with the investigation, and a 38.1% tax rate on automakers that did not cooperate with the investigation.

The new tariffs would be on top of the 10 percent already imposed by the European Union. Manufacturers such as Tesla and BMW that build cars in China and export them to Europe are considered partners.

The tariffs announced by the European Union are higher than the industry's previous expectations of imposing 10% to 25% on Chinese electric vehicles.

The move is seen as a counterattack by European automakers against the influx of low-cost electric vehicles from Chinese rivals into the European market.

If countervailing duties are imposed, it would amount to billions of euros in extra costs for Chinese automakers struggling with slowing domestic demand and falling prices.

Provisional European Union tariffs will begin on July 4, and the countervailing investigation will continue until November 2, at which point final tariffs will likely be imposed, usually for five years. The China Automobile Dealers Association appears less concerned.

"The European Union's temporary tariffs are basically within our expectations, averaging about 20 percent, and will not have much impact on most Chinese companies," said Cui Dongshu, secretary general of the China Automobile Dealers Association. "Chinese-made electric vehicle exporters, including Tesla, Geely, and BYD, still have huge potential for development in Europe in the future."

Some economists say the direct economic effect of countervailing duties will be very small because the European Union imported about 440,000 electric cars from China, worth 9 billion euros (9.70 billion dollars), or about 4 percent of its household car spending from April 2023 to April 2024.

"But countervailing duties are designed to limit future growth in EV imports, not hinder existing trade," said Andrew Kenningham, chief European economist at Capital Economics, a prominent UK economic research firm.

"This decision marks a significant shift in the European Union's trade policy because while the European Union has frequently used protectionist measures in recent years, it has never before done so against such an important industry. Since the Trump presidency, Europe has been reluctant to adopt the kind of protectionism that the United States has adopted," he said.

Countervailing duties could help European automakers compete with their Chinese counterparts, but could also backfire on Chinese automakers that have already made significant long-term investments in Europe.

As the European Union investigates Chinese auto subsidies and considers tariffs on imports, European Union governments are rolling out their incentives to attract Chinese automakers looking to build factories in Europe.

Chinese automakers such as BYD, Chery Automobile, and SAIC are setting up factories in Europe to build their brands and save on freight and potential tariffs.

The European Union has adopted a ladder tax rate for cars imported from China, and different car companies have different tax rates and different treatment.

Auto Business Review understands that this may be related to the export sales volume of car companies and the nature of the enterprise. The highest tax rate is levied on state-owned enterprises that export the most and have won the most European patents and awards.

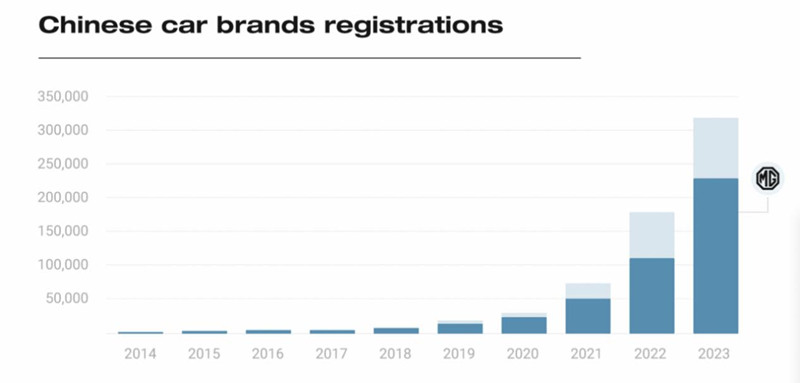

According to the data of JATO Dynamics, in 2023, in the European market, the number of Chinese car brands registered was 323,000, an increase of 79% year-on-year, and the market share reached 2.5%. Among them, the number of SAIC MG licenses exceeded 230,000, accounting for nearly 72%.

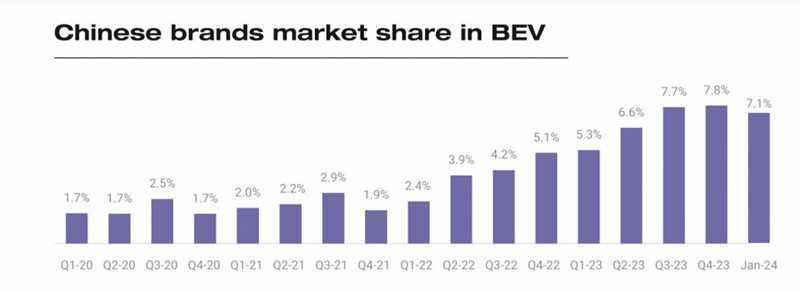

According to data from Schmidt Automotive Research, Geely Automobile accounted for 12.7% of all-electric vehicle registrations in Western Europe in April this year, ranking second only to Volkswagen Group.

Geely owns many European brands such as Volvo, Polaris, Smart, and Aston Martin, and has a unique advantage in the European market.

According to a survey by JATO Dynamics, there are 491,000 Chinese brand cars licensed in Europe, 65% of which are made in China. China is a popular destination for foreign investment and an important export center. Tesla, Dacia, Volvo, MINI, BMW, and Polaris all import Chinese-made models.

Newcomer BYD has the lowest tariffs. Earlier this year, BYD announced that it would become the official travel partner of Euro 2024.

BYD's sponsorship of the European Championship has been significant. In a survey of European and German car owners conducted by consulting firm Horváth in April, BYD was the most well-known Chinese automaker, with 54% of respondents mentioning the car brand.

This may be the reason why it is also included in the punishment, but the punishment is the lightest.

NIO will be subject to a 21% countervailing duty.

NIO said it strongly opposes the use of tariffs as a tactic to block normal global trade in electric vehicles. This approach hinders rather than promotes global environmental protection, emissions reduction, and sustainable development.

"In Europe, NIO's commitment to the electric vehicle market is unwavering, and despite protectionism, we will continue to serve our users and explore new opportunities across Europe. We will closely monitor developments and make decisions that are in the best interests of our business. As the ongoing investigation has not yet concluded, we remain hopeful of a solution."

At the opening of the NIO brand store in Amsterdam, the Netherlands, in May, Li Bin, NIO's chief executive, said: "The European Union Commission's investigation is not justified. Anyone who has been to the Beijing auto show recently has seen how Chinese automakers are trying to use the most advanced technology on the market to promote decarbonization and environmental protection. It is a very competitive market. These manufacturers depend on supplying their products outside of China to survive. These tariffs will deprive Chinese companies of the opportunity to supply their products around the world. That is why we oppose this approach."

Li Bin believes that the new tariffs will not change NIO's business model as a high-end brand. NIO currently has no plans for any production in Europe. Li Bin believes that it is reasonable to sell 100,000 cars in Europe and establish its factory. Its new sub-brand Onvo and third brand Firefly plan to enter the European market between the end of 2024 and the beginning of 2025. Geely Automobile Group told Automotive Business Review it was studying the European Union documents.

The Chinese Ministry of Commerce and the Ministry of Foreign Affairs have expressed their firm opposition, strong dissatisfaction, and high concern. China urges the European Union to immediately correct its wrong practices, earnestly implement the important consensus reached at the recent trilateral meeting between China, France, and Europe, and properly handle economic and trade frictions through dialogue and consultation. China will closely follow the follow-up progress of the European side and will resolutely take all necessary measures to safeguard the legitimate rights and interests of Chinese enterprises.

Mercedes-Benz Group said it always supported free trade based on WTO rules, including the principle that all market participants should be treated equally. "Free trade and fair competition will bring prosperity, growth, and innovation to all. If protectionist trends are allowed to rise, there will be negative consequences for all stakeholders. We will closely monitor developments."

The Volkswagen Group said that in the long run, the imposition of countervailing duties is not conducive to the improvement of the competitiveness of the European automotive industry. The European Union Commission made this decision at an inappropriate time. The decision will do more harm than good for the European automotive industry, especially in Germany. What Europe needs is regulatory environments that promote the transition of the automotive industry to electrification and climate neutrality.

The Volkswagen Group believes that free and fair trade and open markets are the foundation for global prosperity, job security, and sustainable growth. As a global company, the Volkswagen Group supports and advocates open, rules-based trade policies.

The BMW Group has a clear position on anti-subsidy investigations.

Commenting on the European Union's tariff increase, BMW Group chairperson Zeptzer said: "The European Union Commission's decision to impose tariffs on Chinese electric vehicles is wrong. The imposition of tariffs will hinder the development of European car companies, and it will also harm Europe's interests. Trade protectionism is bound to trigger a chain reaction: responding to tariffs with tariffs, and replacing cooperation with isolation. For the BMW Group, protectionist measures such as increasing import tariffs cannot help companies improve their global competitiveness. The BMW Group is a firm advocate of free trade."

Frank Schwope, lecturer in the automotive industry at FHM University of Applied Sciences in Hanover, said: "The tariffs are actually lower than many people expected, and the original plan is still subject to revision. These measures are a disaster for European car buyers and German automakers. The heads of BMW, Volkswagen, and Mercedes-Benz have made it clear that they oppose such punitive tariffs. China is by far the most important sales market for all German automakers. Of course, China is a negligible market for French automakers, and they would benefit from measures targeting Chinese imports into Europe. Punitive tariffs would certainly trigger countermeasures from the Chinese government."

"The European Union Green Deal promises to boost growth and jobs, but that's not possible if we import all of our electric cars, so tariffs are understandable," said Julia Poliscanova, transport and environment director at Environment Europe. "But Europe needs strong industrial policies to accelerate electrification and localized manufacturing. Simply introducing tariffs and removing the 2035 deadline for polluting cars would slow the transition and be counterproductive."

The European Automobile Manufacturers Association (ACEA) said: "ACEA has always believed that free and fair trade is essential to building a globally competitive European automotive industry, while healthy competition drives innovation and provides consumers with choice. Free and fair-trade means ensuring a level playing field for all competitors, but it is only an important part of global competitiveness."

ANFAC, the Spanish association of car manufacturers, said: "ANFAC has traditionally defended free competition in the market, regardless of where the goods come from, as long as all transactions comply with current international trade legislation and are carried out on equal terms. If someone does not comply, he must be punished. Cars contribute more than 18 billion euros to the Spanish economy every year in a trade surplus, and our future depends on the global opening of markets to develop the competitiveness of our industry. Likewise,

we advocate for strong industrial policies in the European Union, and in particular in Spain, to encourage the domestic production and manufacture of electric vehicles and to attract new investment, all in a manner consistent with free trade and competition protection regulations."

Markus Ferber, a German member of the European Parliament, said: "The European Union Commission has made the right decision to impose tariffs on Chinese electric vehicles. In terms of trade policy, the European Union can no longer turn a blind eye to China's dumping like a deer caught in the headlights. If the European Union wants to build a competitive electric vehicle industry, we need to fight back. We can't expect European automakers to invest massively in new capacity when they are hit by Chinese dumping. We've seen similar stories in the solar industry before, and it didn't end well. We'd better not make the same mistake twice. Tariffs and other trade barriers are always only a last resort, but if the competition is not fair, there is no alternative. This is not an act of protectionism, but a measure of fair competition. "

Made in Europe

On May 28, Great Wall closed its European headquarters in Munich and adopted an agency model, focusing on Germany, the United Kingdom, Ireland, Sweden, and Israel through cooperation with dealer group Emil Frey, and not opening up new markets in Europe for the time being. However, according to local media reports, the Budapest government is still negotiating with Great Wall Motors for its first factory in Europe. Hungary will provide funds to create jobs, reduce taxes, and relax regulations in target areas to attract foreign investment.

Hungary produced about 500,000 vehicles in 2023 and won BYD's first factory investment project in Europe. BYD is also considering building a second factory in Europe in 2025. Leap motor will use the existing production capacity of its French-Italian partner Stellantis and choose the Tychy plant in Poland as a manufacturing base.

The Polish Ministry of Development and Technology revealed that Poland currently has multiple projects supporting investments of more than $10 billion, including a project to support the transition to a net zero economy and another for corporate income tax exemptions in areas with high unemployment, with a reduction of up to 50%.

Spain and Italy have also put out real money to encourage various capitals to invest in the construction of electric vehicle factories in their own countries. Spain is the second largest automobile manufacturer in Europe after Germany and has now received investment from Chery. Chery will start production with local partners at a former Nissan plant in Barcelona in the fourth quarter of this year.

Starting in 2020, Spain has launched a 3.7-billion-euro project plan to attract electric vehicles and battery factories. According to local media reports, Chery plans to build a second, larger factory in Europe and has negotiated with local governments including Rome. Rome is eager to attract a second automaker to compete with Fiat's manufacturing parent company Stellantis.

BYD's exhibition point in Milan, Italy.

Italy could offer incentives to car buyers and manufacturers using its National Automobile Fund, which will provide 6 billion euros between 2025 and 2030. Dongfeng Group is one of several other automakers in investment talks with Rome.

SAIC Motor, which owns the MG brand, plans to build two plants in Europe. Germany, Italy, Spain and Hungary are all on the list of locations for SAIC.

However, by investing in European factories, Chinese automakers face rising costs in everything from labor to energy to regulatory compliance.

Di Loreto of Bain & Company said that labor costs in northern Europe are too high to produce competitively, while Italy or Spain further south offer lower labor costs and relatively high manufacturing standards - especially important for premium cars.

Attractive locations for low-cost vehicles also include eastern Europe and Turkey, which currently produces about 1.50 million vehicles a year, mainly for the European Union, and has held talks with BYD, Chery, SAIC, and Great Wall, Mr. Loretto said.

Turkey's customs union with the European Union and free trade agreements with non-European Union countries ensure that it can export cars and parts duty-free.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------